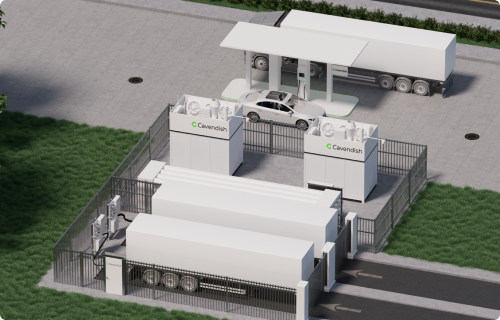

Oslo, 31 May 2024: Reference is made to the stock exchange announcements by Nel ASA (“Nel“, OSE: NEL) on 28 February and 15 May 2024 regarding the potential spin-off of Nel’s Fueling division into a separate company, Cavendish Hydrogen ASA (“Cavendish” or the “Company“), and listing of the Company’s shares on the Oslo Stock Exchange.

The Company has today applied for its shares to be admitted to trading on the Oslo Stock Exchange (the “Listing”). Furthermore, Cavendish will be hosting investor meetings 3-7 June 2024, in addition to a group investor meeting at 14:00 CEST on Thursday 6 June 2024. Anyone wishing to attend can register by contacting one of the Managers (as defined below).

Please find attached the company presentation to be used in investor meetings, which is also available on Cavendish’ website, https://cavendishh2.com/.

The spin-off and Listing are still subject to satisfaction of certain conditions, including inter alia the approval by the Oslo Stock Exchange, satisfaction of any conditions set for such approval, Nel’s board of directors resolving to distribute the shares in Cavendish to the shareholders of Nel as dividend in kind, and approval of a listing prospectus by the Financial Supervisory Authority of Norway. Although the spin-off and Listing remain on schedule with regard to Listing by end of Q2 2024, no assurance can be given that it will be completed.

Carnegie AS is acting as global coordinator, and Arctic Securities AS and Fearnley Securities AS as joint lead managers (together the “Managers“) to Nel and Cavendish in connection with the spin-off and Listing.

Register for investor meetings by contacting respective sales representatives at one of the Managers or by sending an email to ca@carnegie.no, events@arctic.com or corp.access@fearnleys.com.

IMPORTANT NOTICE

These materials do not constitute or form a part of any offer of securities for sale or a solicitation of an offer to purchase securities of Nel ASA or Cavendish Hydrogen ASA (each an “Issuer”) in the United States or any other jurisdiction. The securities of the Issuer may not be offered or sold in the United States absent registration or an exemption from registration under the U.S. Securities Act of 1933, as amended (the “U.S. Securities Act”). The securities of the Issuer have not been, and will not be, registered under the U.S. Securities Act. Any sale in the United States of the securities mentioned in this communication will be made solely to “qualified institutional buyers” as defined in Rule 144A under the U.S. Securities Act. No public offering of securities will be made in the United States.

In any EEA Member State, this communication is only addressed to and is only directed at qualified investors in that Member State within the meaning of the EU Prospectus Regulation, i.e., only to investors who can receive any offering without an approved prospectus in such EEA Member State. The “EU Prospectus Regulation” means Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 (together with any applicable implementing measures in any Member State).

In the United Kingdom, this communication is only addressed to and is only directed at Qualified Investors who (i) are investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (as amended) (the “Order”) or (ii) are persons falling within Article 49(2)(a) to (d) of the Order (high net worth companies, unincorporated associations, etc.) (all such persons together being referred to as “Relevant Persons”). These materials are directed only at Relevant Persons and must not be acted on or relied upon by persons who are not Relevant Persons. Any investment or investment activity to which this announcement relates is available only to Relevant Persons and will be engaged in only with Relevant Persons. Persons distributing this communication must satisfy themselves that it is lawful to do so.

This announcement is for information purposes only and is not to be relied upon in substitution for the exercise of independent judgment. It is not intended as investment advice and under no circumstances is it to be used or considered as an offer to sell, or a solicitation of an offer to buy any securities or a recommendation to buy or sell any securities of the Issuer. Neither the Issuer, the Managers nor any of their respective affiliates accepts any liability arising from the use of this announcement.

The publication, distribution or release of this announcement and other information may be restricted by law in certain jurisdictions. Persons into whose possession this announcement or such other information should come are required to inform themselves about and to observe any such restrictions. Specifically, neither this announcement nor the information contained herein is for publication, distribution, or release, in whole or in part, directly or indirectly, in or into or from the United States (including its territories and possessions, any State of the United States and the District of Columbia), Australia, Canada, Hong Kong, Japan or any other jurisdiction where to do so would constitute a violation of the relevant laws of such jurisdiction.

Matters discussed in this announcement may constitute forward-looking statements. Forward-looking statements are statements that are not historical facts and may be identified by words such as “anticipate”, “believe”, “continue”, “estimate”, “expect”, “intends”, “may”, “should”, “will” and similar expressions. The forward-looking statements in this release are based upon various assumptions, many of which are based, in turn, upon further assumptions. Although the Issuer believes that these assumptions were reasonable when made, these assumptions are inherently subject to significant known and unknown risks, uncertainties, contingencies and other important factors which are difficult or impossible to predict and are beyond its control. Such risks, uncertainties, contingencies and other important factors could cause actual events to differ materially from the expectations expressed or implied in this release by such forward-looking statements. The information and any forward-looking statements contained in this announcement speak only as of its date, and are subject to change without notice.

The Managers are acting for the Issuer and no one else in connection with the spin-off and Listing and will not be responsible to anyone other than the Issuer for providing the protections afforded to their respective clients, or for advice in relation to the contents of this announcement or any of the matters referred to herein. Neither the Managers nor any of their respective affiliates or any of their respective directors, officers, employees, advisers, or agents accept any responsibility or liability whatsoever for, or makes any representation or warranty, express or implied, as to the accuracy, completeness or fairness of the information and opinions in this announcement (or whether any information has been omitted from this announcement) or any other information relating the Issuer or associated companies. Each of the Issuer, the Managers and their respective affiliates expressly disclaims any obligation or undertaking to update, review or revise any statement contained in this announcement whether as a result of new information, future developments or otherwise.